How Can Interest Rate Swaps Be the Answer to Rising Rates?

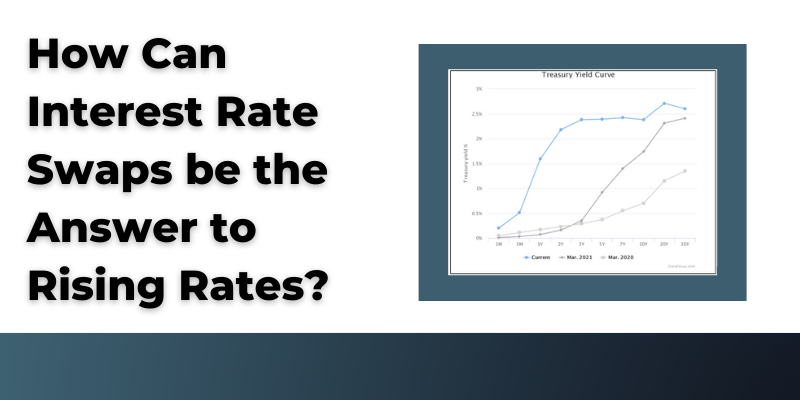

Supply chain pressures, inflation, global conflicts and potential COVID resurgences…no matter what’s going on in the economy, it seems one of these challenges keeps popping up. All the uncertainty, and to a large degree the increase in inflation, is pushing interest rates higher. Look at the chart of the U.S. Treasury curve over the past two years (pictured above).

Those who do a lot of mortgage lending or investing in long-term securities know all too well what has been happening. The rise in interest rates has caused the values of our mortgage portfolios and long-term investments to decline.

Some credit unions and board members have said, “Maybe we should stop or slow down our mortgage lending.” My answer to them is always the same: Wait, let’s talk this through first.

None of us like uncertainty. We want to operate in a safe, “known” space. But universally avoiding an asset class just because interest rates start to move is not always the best plan. Uncertainty does create risk, and interest rate risk is a key metric where this risk shows up. However, instead of exiting a key asset class that provides strong value to credit unions and members, consider looking for ways to manage, rather than avoid, that risk.

With the recently revised interest rate derivatives rule, credit unions can more readily tap into this well-known product designed specifically to address this challenge.

Various interest rate derivative products are available, but the most commonly used product in the credit union industry is the “plain vanilla” interest rate swap. A plain vanilla interest rate swap is a transaction in which a fixed rate interest rate payment is “swapped” for a floating rate interest rate payment. This product can be used to turn a fixed rate payment stream into a floating rate payment stream, thereby significantly reducing the interest rate risk.

Catalyst Strategic Solutions can evaluate your credit union’s assets and devise a strategy aimed to manage the interest rate risk generated by real estate loans, commercial loans, or other products on the balance sheet. This will enable your credit union to continue meeting member loan demand without constantly bumping up against interest rate risk policy limits.

Are interest rate swaps the only option? Absolutely not. Historically, credit unions turned to borrowings as a tool to accomplish this task. However, in today’s environment, where net worth ratios are already under pressure and credit unions hold undefined levels of potentially “hot” money, using borrowing capacity to offset interest rate risk may not be the best strategy. The reason is simple. If you use borrowings (secondary liquidity sources) to reduce interest rate risk, you are, in essence, trading one risk for another. In this case, accessing borrowings decreases remaining borrowing capacity, which therefore increases your liquidity risk exposure. The degree and significance of this risk trade-off will vary based on your unique situation.

This is where interest rate derivatives offer some key advantages. They are not a liquidity tool; they are an interest rate risk management tool, which means they don’t increase liquidity risk exposure. Even better, interest rate swaps are typically less expensive than term funding, which means you can lock in a better spread on the risk you offset. Another benefit is the added flexibility interest rate swaps offer relative to borrowings. You can get in and out of swaps without those pesky prepayment penalties that accompany unwinding a borrowing early.

With interest rates rising the past few months and their continued path unknown, now is a good time to lock in spread on your lending and manage down your long-term earnings risk without sacrificing liquidity. Interest rate derivatives are a tool that allows you to do this effectively and efficiently.

Want to see how a strategy for your credit union might look? Visit the Catalyst Corporate Derivative Hedging Services webpage to learn more.

As Managing Principal at Catalyst Strategic Solutions, Mark directs risk consulting, balance sheet advisory and broker/dealer services for credit unions nationwide. Formerly the organization’s Vice President of ALM Services, Mark has 16 years’ experience consulting credit unions on interest rate risk, liquidity risk, strategic planning, member deposit behaviors and mortgage servicing portfolios.

Subscribe

Sign up to the receive Cornerstone Resources blog notifications.

Need Solutions?

Cornerstone Resources offers a wide variety of products and services tailored to credit union interests.