Cornerstone honors five CUs for exceptional youth financial education programs

Editor’s note: This is the second article in a four-part series featuring credit union initiatives selected by the Cornerstone League for the Credit Union National Association’s national awards.

The Cornerstone League recognized A+ Federal Credit Union, Tinker Federal Credit Union, and Resource One Credit Union as the first-place winners of the Credit Union National Association’s Desjardins Youth Financial Education Awards. For second place, the League honored GECU and Education Credit Union.

This award recognizes leadership within the credit union on behalf of financial literacy. Following are descriptions of their outstanding financial education programs.

A+ Federal Credit Union, Austin, Texas

More than $1 billion in assets

A+FCU

Throughout the year, A+FCU partners with schools and organizations to provide free financial education to youth. This includes collaborating with schools for in-class presentations, hosting Mad City Money™ financial simulations, hosting Youth Financial Camps, and helping Boy Scout members earn their Personal Management Merit Badges.

- In-class presentations: Delivered more than 130 in-class presentations for elementary, middle, and high school students, covering topics like saving, taxes, fraud, financial aid, budgeting, careers, and paying for college.

- Youth Financial Camps: Taught nearly 200 kids in grades three-eight about compound interest, entrepreneurship, fraud, smart shopping, and advertising.

- Mad City Money simulations: Hosted nine simulations for 2,325 students, giving them hands-on experience budgeting in a real-world environment.

- High School Boot Camps: Trained 45 students on paying for college, understanding paychecks and taxes, improving credit, and protecting their identity.

- Partnership with the Boy Scouts of America Capitol Area Council: Helped 110 scouts earn their Personal Management Merit Badges, providing instruction on credit, saving, investing, budgeting, types of insurance, time management, and project management.

Tinker Federal Credit Union, Oklahoma City, Okla.

More than $1 billion in assets

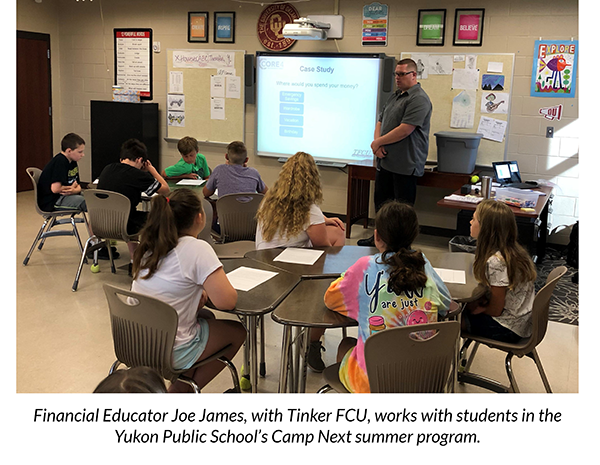

Yukon Public Schools—Camp Next—TFCU Financial Education Workshops

Tinker Federal Credit Union (TFCU) partnered with Yukon Public School’s Camp Next to provide financial education for students entering grades six-eight. Through this partnership, TFCU financial counselors provided two financial education workshops once a week for seven weeks. Through presentations and activities, students learned how to create a family budget and how their decisions impact their ability to live the life they want.

In 2019, TFCU presented 886 financial education workshops to youth and adults with 29,515 in attendance. Of those served, 24,561 were youth attendees at 647 financial education workshops. The credit union exceeded its goal of attendees by 28% over the previous year.

Resource One CU, Dallas, Texas

250 million—$1 billion in assets

Young Adult Financial Education

This year, Resource One Credit Union increased financial literacy for youth and young adults through reality fairs for middle, high school, and college students; a BizKid$ competition; classroom instruction; field trips for elementary schools; and a financial literacy curriculum for elementary education. A unique partnership with Dallas College created a location for Reality Fairs, where the local high schools bused in students, creating access for more schools to participate in a single event.

- Reality Fairs: Collaborated with six learning institutions to conduct reality fairs for 1,567 students.

- Collegiate Program: Partnered with Eastfield College and Dallas ISD’s Collegiate Program to provide students with a classroom program about better money management to prepare for college graduation and obtaining their first job.

- BizKid$ Entrepreneur Contest: Sponsored Trinity Basin Preparatory School in the Cornerstone Foundation’s 2019–2020 BizKid$ Entrepreneur Contest. Three classes of 65 students learned about money management, entrepreneurship, social responsibility, and student and learner collaboration.

- Elementary Education: Supported second graders at Liberty Grove Elementary School by collaborating with educators and providing students with lessons and hands-on experiential activities to help them better understand money management.

GECU, El Paso, Texas

More than $1 billion in assets

2019 Student Board of Directors by GECU

The Student Board of Directors by GECU offers local high school seniors an opportunity to receive firsthand knowledge about GECU’s operations and learn about financial skills, all while becoming better prepared for college, the workforce, and community involvement. Through this program, 16 students serve a one-year term, and in turn, they serve as financial literacy ambassadors and extend their learning to their family, friends, classmates, teachers, and advisers, reaching easily more than 350 individuals.

GECU assisted students with mock career interviews and scholarship application assistance. Through this program, students gained insights into what the professional “real world” looks like. They also learned about student loans and how to prepare financially for college.

Education First Credit Union, Beaumont, Texas

$250 million–$1 billion assets

C.A.F.E. Secret Agent Training Module

Education First Federal Credit Union realized there was a need in elementary schools for financial literacy resources. In Texas, fifth-grade students are tested on several financial literacy topics and concepts, but resources on those topics are not readily available.

With this in mind, Education First FCU developed an off-shoot of its youth savings program—a classroom workbook geared specifically to meet the math/financial education requirements of the fifth grade Texas Essential Knowledge and Skills (TEKS) exam.

The C.A.F.E. (Center for Advanced Financial Experimentation) Secret Agent Training Module is a free 15-page full-color workbook that leads students through training modules, from saving and spending to budgeting and vocabulary building through games, puzzles, and simulations. For the 2019-2020 school year, 14 school districts adopted the program, instructing more than 3,315 fifth graders.

Subscribe

Sign up to the receive the weekly Leaguer email. Existing subscribers can manage their subscription.